Press Release

Aurubis: 2020/21 the most successful fiscal year in company history, dividend recommendation of € 1.60

Hamburg | Friday, December 3, 2021

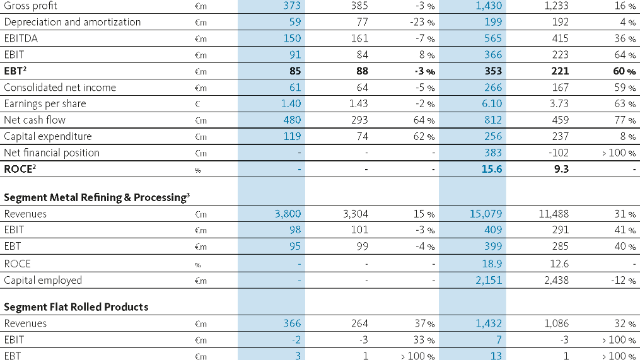

- Operating EBT rose by 60 % to € 353 million (previous year: € 221 million) in FY 2020/21, the highest result in Group history

- Executive Board and Supervisory Board to recommend a dividend of € 1.60 per share at the Annual General Meeting

- Updated corporate strategy: Strengthening core business, growth in recycling in particular, expanding forerunner role in sustainability

- Aurubis confirms it wants its production to be carbon-neutral well before 2050

The Aurubis AG (Aurubis) fiscal year 2020/21, which ended on September 30, was the most financially successful in the company’s history: with € 353 million, the multimetal producer generated outstanding operating earnings before taxes (EBT) overall, exceeding the prior-year result (€ 221 million) by about 60 %. Aurubis therefore significantly surpassed the forecast for the fiscal year as well. Operating ROCE (return on capital employed) also increased, reaching 15.6 % (previous year: 9.3 %). The result for Q4 was € 85 million (Q4 of the previous year: € 88 million).

In light of the outstanding result, the Aurubis Executive Board and Supervisory Board will recommend a – yet again – increased dividend of € 1.60 per share (previous year: € 1.30) at the Annual General Meeting on February 17, 2022, which will take place digitally again. If the shareholders at the Annual General Meeting accept this recommendation, the payout ratio will be 26 % (previous year: 35 %) of the operating consolidated net result.

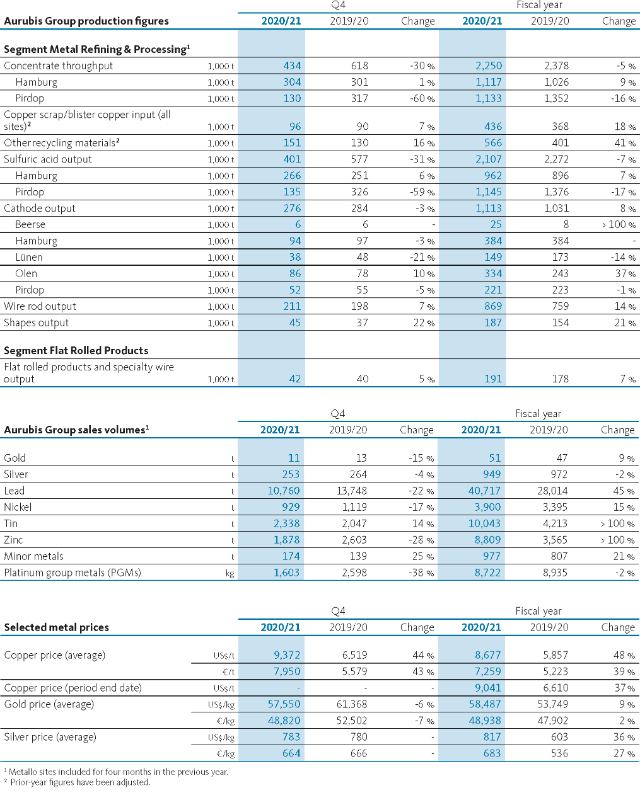

Despite challenges: Good plant availability, high demand, increased metal prices

Aurubis maintained a good ongoing supply on both the primary raw material side (concentrates) as well as for recycling materials – secondary raw materials. Strong increases in refining charges for copper scrap and other recycling materials positively impacted the result as well. Furthermore, Aurubis benefits from a very good metal result with strongly increased metal prices, especially for copper, nickel, and tin. High product demand also supported the result. High energy costs had the reverse effect. The IFRS consolidated earnings before taxes (EBT) were € 826 million (previous year: € 367 million).*

We’re proud of the achievements in a fiscal year that was still under coronavirus conditions for the most part – it went fairly smoothly despite this and other challenges, such as supply chain bottlenecks and rising energy prices. Additional positive factors included high plant availability across the Group, the swift and successful integration of the new recycling sites in Belgium and Spain into the Group, and the consistent ongoing implementation of our cost reduction program,

emphasizes Roland Harings, CEO of Aurubis AG.

However, there was some less positive news as well: for example, the plant in Stolberg (in the German state of North-Rhine Westphalia) was destroyed following severe flooding in summer 2021, though it was evacuated beforehand. No employees were injured. The site has been rebuilt, and production restarted gradually in November. Because the incident was fully insured, Aurubis had no permanent damage.

This wouldn’t have been possible without our employees on site and the prompt, uncomplicated support from the Aurubis Group. We would like to express our deepest thanks and appreciation to our colleagues for this extraordinary accomplishment,

Roland Harings underlines.

Continued strategic growth, especially in recycling

With the very good Group result behind it, the multimetal company continues to push forward with its new realignment. The corporate strategy has been updated and refined. In addition to securing the core business, the recycling business is a key element of the strategy where Aurubis will continue to grow. Harings explains,

We want to responsibly transform raw materials into metals for an innovative and sustainable world. During the past fiscal year, Aurubis processed more than 1 million t of recycling material for the first time – this impressively shows what Aurubis is capable of achieving today in this area alone.

In particular, this growth is planned through local presence in promising international markets. In November, Aurubis announced the construction of a recycling plant in Georgia (US), an investment of about € 300 million. The multimetal recycler wants to process about 90,000 t of complex recycling materials at the new site in Richmond County starting in 2024, further processing the intermediate products into various industrial and precious metals at its European smelter sites to a great extent – but also selling them directly in the US market.

In Beerse, Belgium, Aurubis will invest roughly € 30 million in a state-of-the-art metallurgical facility (ASPA) in the next several years, which will be able to process anode sludge rich in tin and precious metals even better.

Decarbonization: Carbon-neutral production well before 2050

These are initial examples with which Aurubis is reinforcing the circular economy and supporting the European Green Deal and the plans of the American Green New Deal. Roland Harings confirms,

Aurubis is striving to make its production carbon-neutral well before 2050. We see ourselves as a provider of solutions for ecologically sustainable business activity in order to accelerate decarbonization.

For this purpose, Aurubis kicked off various initiatives to reduce CO2 in multimetal production in 2020 and 2021 as well. For example, the use of green hydrogen instead of natural gas was successfully tested in the Hamburg plant’s anode furnace; the consistent use of hydrogen could reduce CO2 emissions by 6,200 t per year in Hamburg alone, provided that there is a cost-efficient supply of green hydrogen.

An industrial pioneer in sustainability

Aurubis is the most sustainable smelter network in the world. This aspiration is underlined in the updated corporate strategy, which includes the addition “Driving Sustainable Growth.”

Our expertise produces high-quality metals and keeps them in the value cycle, conserving raw materials. Our production methods are among the most environmentally friendly worldwide, and we fulfill the highest international standards

, Roland Harings sums it up. Aurubis has had this certified by the renowned rating agency EcoVadis, to name one example – in this case, the multimetal company is among the best one percent in the industry.

Aurubis increases forecast range for fiscal year 2021/22

The past fiscal year showed that Aurubis is in a very good position – from both a financial and an operational perspective – and therefore has the best preconditions for implementing the updated strategy. Aurubis remains ambitious for 2021/22 and wants to build on the best year in the company’s history to date, even in an environment of rising costs and energy prices. Concretely, the multimetal company forecasts an operating EBT of € 320 to 380 million for the current fiscal year. The company expects an operating ROCE of between 12 and 16 % (previous year: between 9 and 12 %).

Supported by industry forecasts and current demand on the markets, Aurubis expects a good supply of copper concentrates, an at least stable supply of recycling materials, and positive global copper demand. The Aurubis copper premium was raised to US$ 123/t for 2022 owing to demand and higher costs (2021: US$ 96).

On December 6, 2021 from 1 p.m. to around 5 p.m. (CET), Aurubis will host a virtual Capital Market Day on the strategy, the markets, and the business segments for analysts and investors. The access link for listen-only mode (no prior registration required) is available on the Aurubis website in the Investor Relations section Capital Market Day

You can read the complete Annual Report 2020/21 and additional information on our website now at annualreport2020-21.aurubis.com.

* Because the IFRS result includes measurement effects of metal price fluctuations from unrealized transactions and other factors, Aurubis discloses an operating result (EBT) that differs from the IFRS result. The operating result largely eliminates these effects of metal price fluctuations from unrealized transactions and thus allows for a more realistic assessment of the business performance. Operating EBT is used for control purposes within the Group.

Downloads

-

Um die heruntergeladene Komponente zu sehen den QR code scannen

Press Release as PDF

PDF

2 MB

Meino Hauschildt

Manager Corporate Communications, Spokesperson

| Phone | +49 40 7883-3037 |