25 years of Aurubis shares

Aurubis shares celebrate their anniversary: 25 years on the stock exchange – 600 % increase in value

The year is 1998 – after 16 years as chancellor, Helmut Kohl is defeated by his challenger, Gerhard Schröder, during the German federal election on September 27. In the US, the Lewinsky affair is making the news. The Kyoto Protocol is signed. And a mid-sized Hamburg company takes the step of going public on July 7, 1998 with an issue price of 25 Deutschmark. A small ring of the stock exchange bell for then-Chairman Werner Marnette, a giant echo in the copper industry.

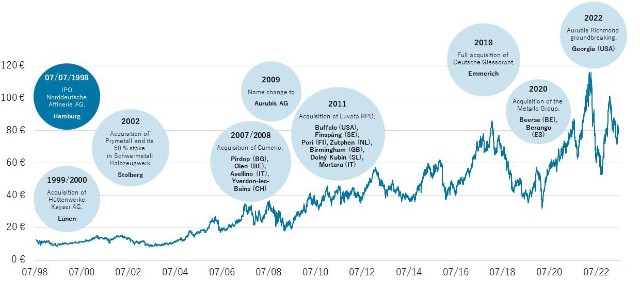

Closing prices of the Aurubis Share

Aurubis' development from a medium-sized German copper producer to an international metal producer

What was then called Norddeutsche Affinerie (NA) encompassed about 2,000 employees at the only smelter site, Hamburg. It produced around 500,000 t of copper and copper products from 100 % copper concentrate annually and generated EBT of approximately € 78 million in the year preceding the IPO. The step of going public fundamentally changed the ownership structure; a majority of the NA shares were issued to retail and institutional investors. The goal of the IPO was to gain more independence and to create financial headroom. To have more space for growth and ongoing strategic development. In the years leading up to the IPO, NA’s international owners had placed their strategic focus on maximizing the dividend to make up for their financial difficulties – a huge strain on the company’s successful continued development.

Fast forward to 2023. And we’ve got a completely different company. With a new name. Aurubis, introduced in 2009, is a creative linguistic homage to the company’s main metal. The name is derived from the Latin aurum rubrum, red gold, a term the Romans used for copper. Today, Aurubis produces 18 other metals apart from copper – and plans to increase this number even further through battery recycling, making Aurubis a leading global multimetal producer. The production volumes of copper cathodes have nearly tripled compared to 1998, and they now consist of almost 50 % recycling material. Earnings have increased by almost a factor of seven – and Aurubis is now the world’s most efficient and sustainable smelter network with six European smelter sites, additional processing operations around the globe, and a strategy focused on accelerated growth.

This is the result of a stable business model that has been consistently developed via the entrepreneurial freedom granted by the IPO coupled with a powerful, long-standing anchor shareholder with an excellent understanding of the business – Salzgitter AG.

Share-price development reflects the shift from a smelter operation with just one site to a globally active smelter network. Shareholders who got in on the ground floor have watched their investment grow by more than 600 % to today. Even the MDAX, which began listing Aurubis in 2001, can’t keep up. With a rock-solid company that in 25 years has never ended a fiscal year with a negative operating result and defied every crisis. Since the IPO, Aurubis employees have also profited from this attractive development thanks to the opportunity to buy shares at a discounted price through the share program. In 2022, the program put just under 70,000 shares in the hands of employees, turning workers into shareholders, into joint venturers. Maybe that is “just” a sign of how closely the workforce identifies with Aurubis. Or maybe it is the absolute confidence of in-house investors in another 25 successful years on the stock exchange.

With its Metals for Progress: Driving Sustainable Growth strategy, Aurubis has set a clear roadmap for the coming years based on sustainable, profitable growth – and continually expanding its network. The multimetal company consistently invests in securing and strengthening its core business, pursuing growth options – especially in recycling – and further expanding its industry leadership in sustainability. As the most efficient and sustainable smelter network in the world, with its solid business model Aurubis is ideally positioned to enable the global megatrends of tomorrow – for a more digital, innovative, and sustainable future.